Positive Trade Ratio

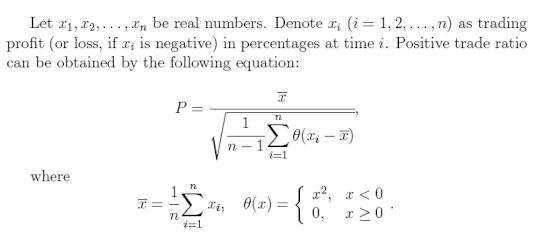

PositiveTrade Ratio is a reward-to-variability ratio similar to

Sharpe ratio.

Both provide a measure of profit per unit of risk.

Like the Sharpe ratio, PTR is directly computable from any

observed series of returns without need for additional information surrounding

the source of profitability.

PTR was developed to overcome the Sharpe ratio limitation where

investments with excessive profits are effectively punished for being

successful, due to the use of standard deviation.

Instead of factoring any deviation from the mean, PTR

calculates only the standard deviation of losing trades.

Therefore PTR is similar to the Sortino ratio, except it is

simplified in that there is no need for a Minimum Acceptable Rate of Return

(MAR) or a complex Downside Deviation (DD).

Click here to download the Positive Trade Ratio Excel File

You may copy and

distribute the Excel file and or formula provided that this notice including the

author's name and

company name

remain in place.